The Benefits of Using Your Equity To Make a Bigger Down Payment

Sheri Smith

Friday, October 18, 2024

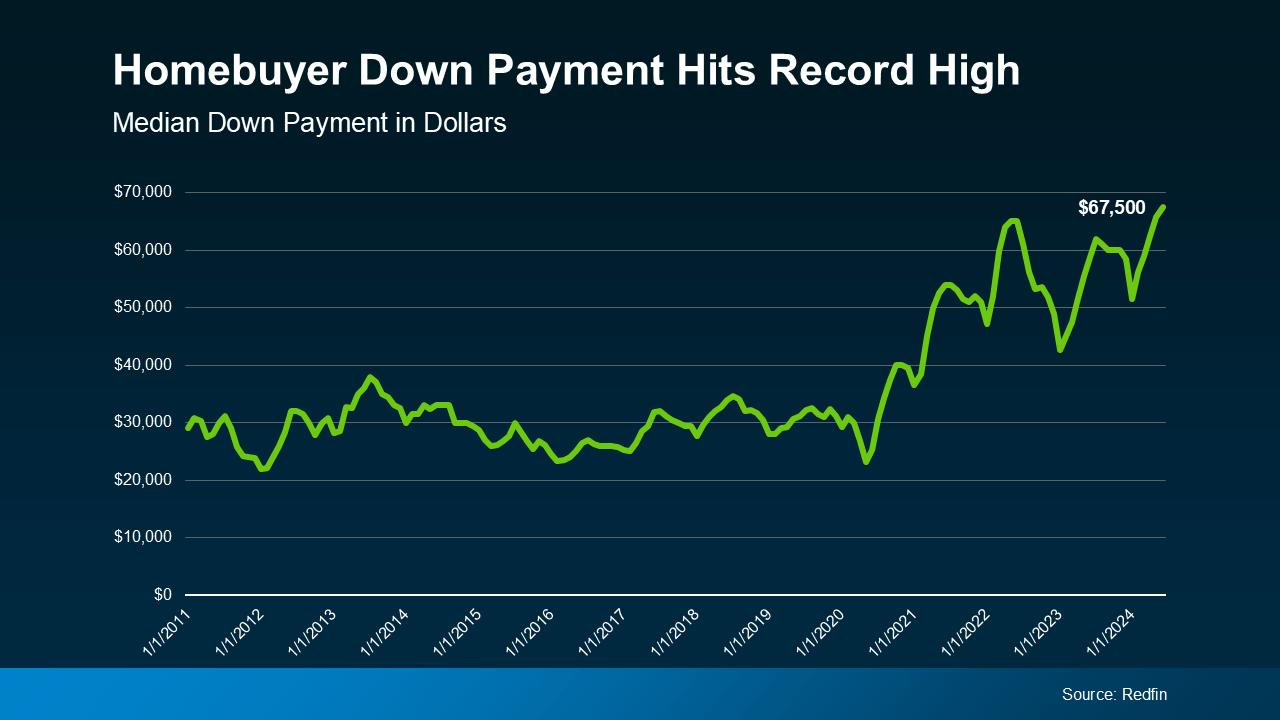

Did you know? Many homeowners can put more money down when purchasing their next home. This is because, after selling, they can leverage the equity built up in their current property for their new down payment. With home equity reaching record levels, median down payments are also at an all-time high.

According to recent data from Redfin, the average down payment for U.S. homebuyers is now $67,500, representing an increase of nearly 15% compared to last year and the highest recorded to date (as shown in the accompanying graph):

The power of equity makes this possible. Over the past five years, significant home price growth has resulted in substantial equity gains for homeowners. When you sell your current home, you can use that equity toward a larger down payment on your next property. This can be especially beneficial if you’re concerned about affordability.

However, keep in mind that you don’t need a large down payment to buy your next home. There are loan options that allow as little as 3% or even 0% down. But many current homeowners choose to put more money down for a number of compelling reasons.

Using your equity for a larger down payment means you’ll need to borrow less. With a smaller loan amount, you’ll pay less in interest over the life of your mortgage, leading to long-term savings.

Potential for a Lower Mortgage Rate

A larger down payment demonstrates your financial stability to lenders, signaling that you are a lower credit risk. This could result in a lower mortgage rate, further enhancing your savings.

Lower Monthly Payments

A substantial down payment doesn’t just reduce the amount you need to borrow—it can also lower your monthly mortgage payments. This can make your new home more affordable and give you more room in your budget.

Avoid Private Mortgage Insurance (PMI)

Putting down 20% or more allows you to bypass Private Mortgage Insurance (PMI), which is an added expense for buyers who make smaller down payments. As explained by Freddie Mac:

By avoiding PMI, you’ll have one less expense to consider each month, which can be a helpful benefit.

The Takeaway

Down payments are reaching record highs, largely driven by recent gains in home equity that position homeowners to put more money down.

If you’re considering selling your current home and moving, let’s connect to determine how much equity you have and explore how it can enhance your buying power in today’s market.

According to recent data from Redfin, the average down payment for U.S. homebuyers is now $67,500, representing an increase of nearly 15% compared to last year and the highest recorded to date (as shown in the accompanying graph):

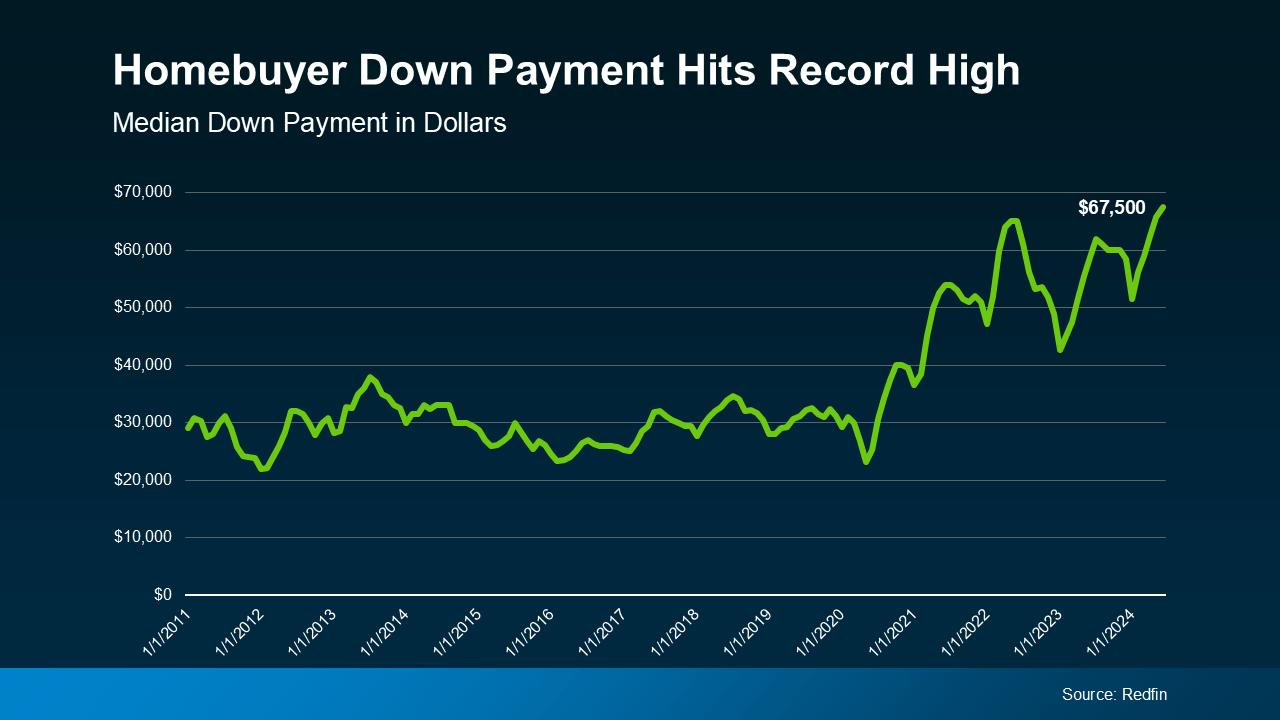

The power of equity makes this possible. Over the past five years, significant home price growth has resulted in substantial equity gains for homeowners. When you sell your current home, you can use that equity toward a larger down payment on your next property. This can be especially beneficial if you’re concerned about affordability.

However, keep in mind that you don’t need a large down payment to buy your next home. There are loan options that allow as little as 3% or even 0% down. But many current homeowners choose to put more money down for a number of compelling reasons.

Why a Bigger Down Payment Can Make a Difference

You’ll Borrow Less and Save More Over TimeUsing your equity for a larger down payment means you’ll need to borrow less. With a smaller loan amount, you’ll pay less in interest over the life of your mortgage, leading to long-term savings.

Potential for a Lower Mortgage Rate

A larger down payment demonstrates your financial stability to lenders, signaling that you are a lower credit risk. This could result in a lower mortgage rate, further enhancing your savings.

Lower Monthly Payments

A substantial down payment doesn’t just reduce the amount you need to borrow—it can also lower your monthly mortgage payments. This can make your new home more affordable and give you more room in your budget.

Avoid Private Mortgage Insurance (PMI)

Putting down 20% or more allows you to bypass Private Mortgage Insurance (PMI), which is an added expense for buyers who make smaller down payments. As explained by Freddie Mac:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy that protects the lender in case you cannot pay your mortgage. It’s different from homeowner's insurance and is a monthly fee added to your mortgage payment if your down payment is below 20%.”

By avoiding PMI, you’ll have one less expense to consider each month, which can be a helpful benefit.

The Takeaway

Down payments are reaching record highs, largely driven by recent gains in home equity that position homeowners to put more money down.

If you’re considering selling your current home and moving, let’s connect to determine how much equity you have and explore how it can enhance your buying power in today’s market.

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !